Endogenous Stock Market Participation: Risk Preference and Participation Cost

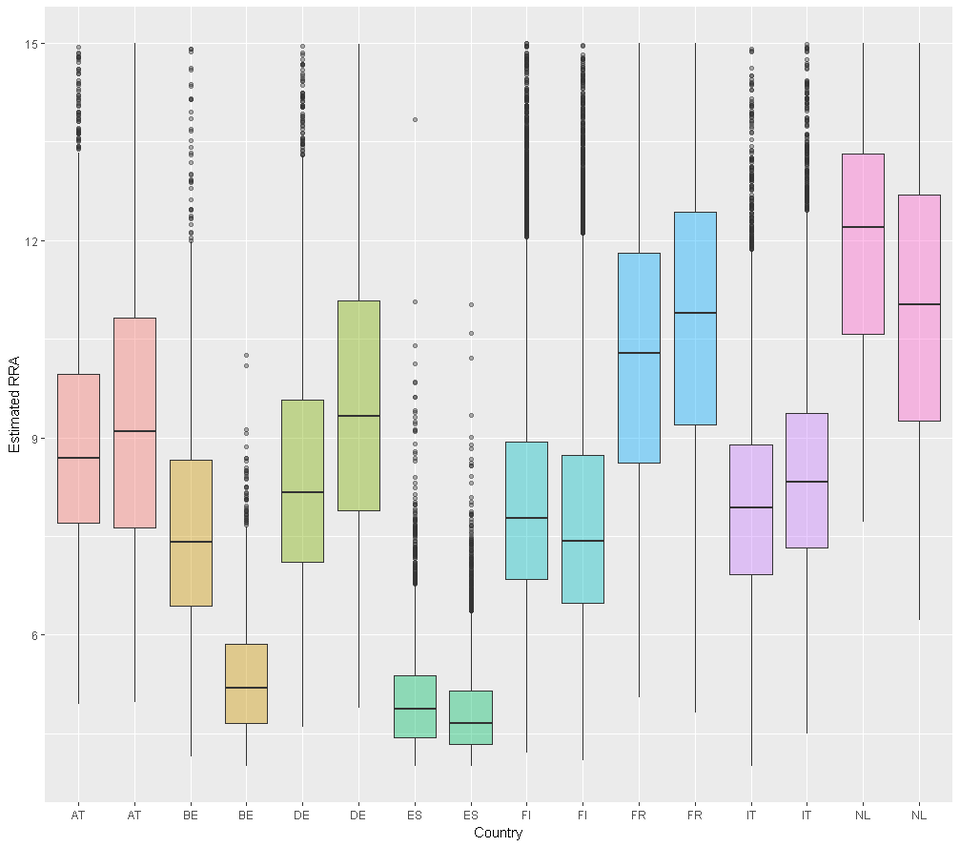

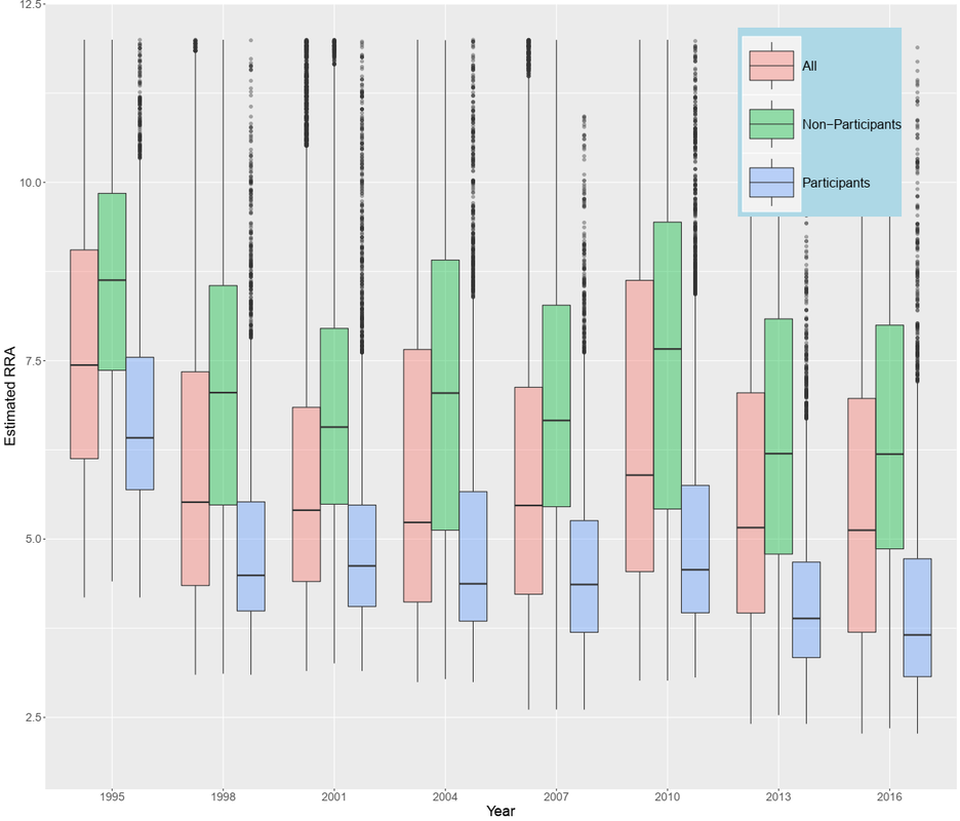

This paper revisits the limited stock market participation puzzle and treats non-participation as an endogenous self-censoring. I employ a censored fractional response model to estimate both participation costs and risk preferences in a reduced form framework using European survey data. I show that all households face non-negligible participation costs, and the non-participants have significantly higher risk aversion than the participants. The new estimation corrects the sample selection bias in estimating risk preference with only participants and suggests an average relative risk aversion around 8.3 and an average participation cost of approximately EUR 80 for European households.

| cfrm_2019.pdf | |

| File Size: | 795 kb |

| File Type: | |

Your browser does not support viewing this document. Click here to download the document.

Relative Risk Aversion in Europe: Evidence from HFCS 2010 and 2014