Housing Yields

with Stefano Colonnello and Roberto Marfè

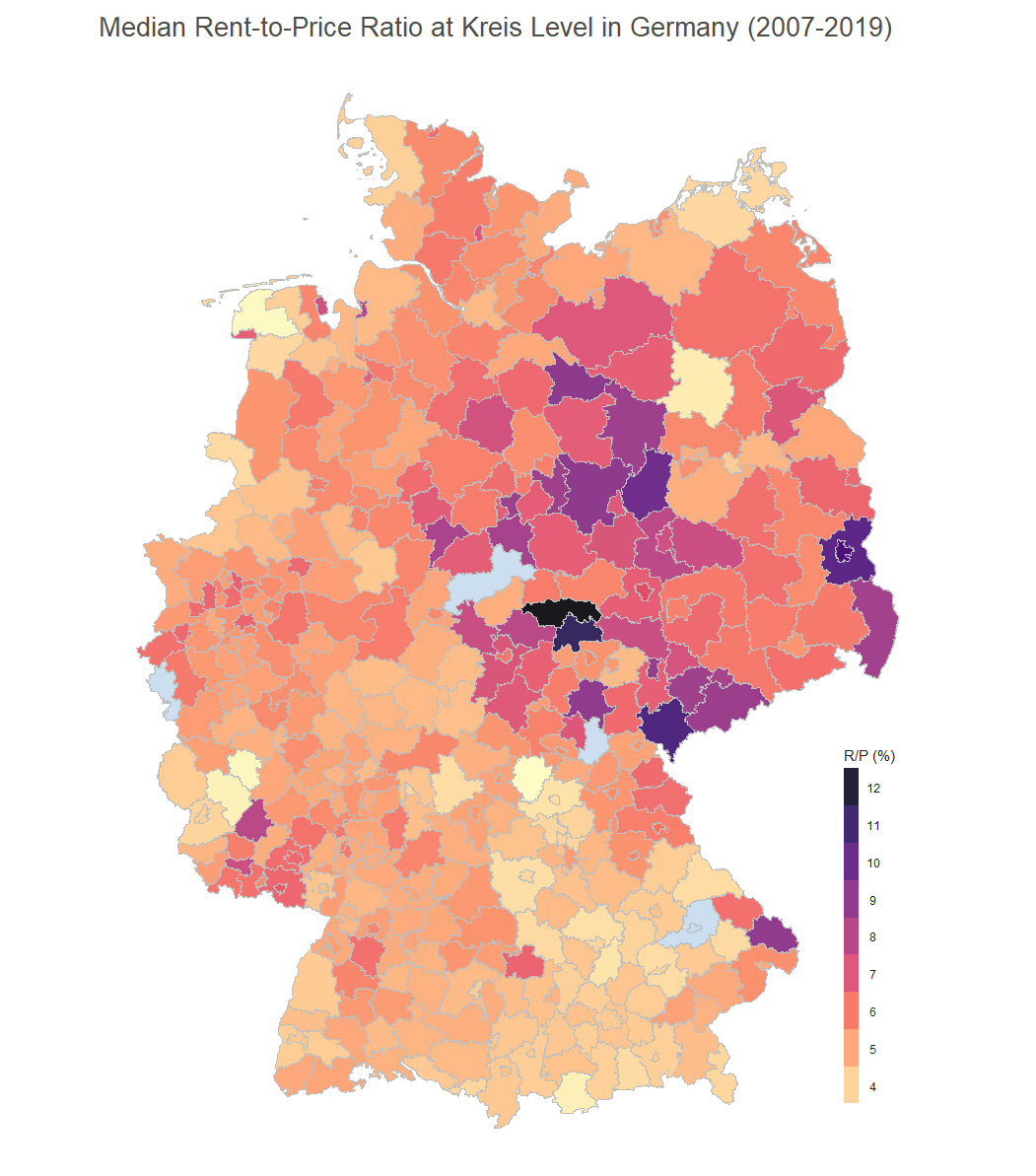

This paper investigates heterogeneity in residential property yields using rental and sale listings from the largest German internet real estate platform. Equipped with property-level rent-to-price ratios obtained via matching properties for sale and for rent, we show that they strongly co-move with local factors, such as population age structure, industry structure, housing supply rigidities, and the liquidity and size of the housing market. Regional differences are particularly pronounced between globally relevant cities and other areas. However, a large fraction of the variation of rent-to-price ratios can be explained neither by local factors nor by an extensive array of property-specific observable features, pointing to the crucial role of idiosyncratic factors and within-city aggregation economies. We then create a pseudo-panel to examine the time-series dimension of house prices and show that the ability of expectations about discount and rent growth rates impounded in rent-to-price ratios to predict return and rent growth is statistically significant but of limited economic magnitude.

| cmx_hy_16022021.pdf | |

| File Size: | 6482 kb |

| File Type: | |

Your browser does not support viewing this document. Click here to download the document.