The Liquidity Premium of Safe Assets: The Role of Government Debt Supply

(IWH Discussion Papers, NO. 11, 2017)

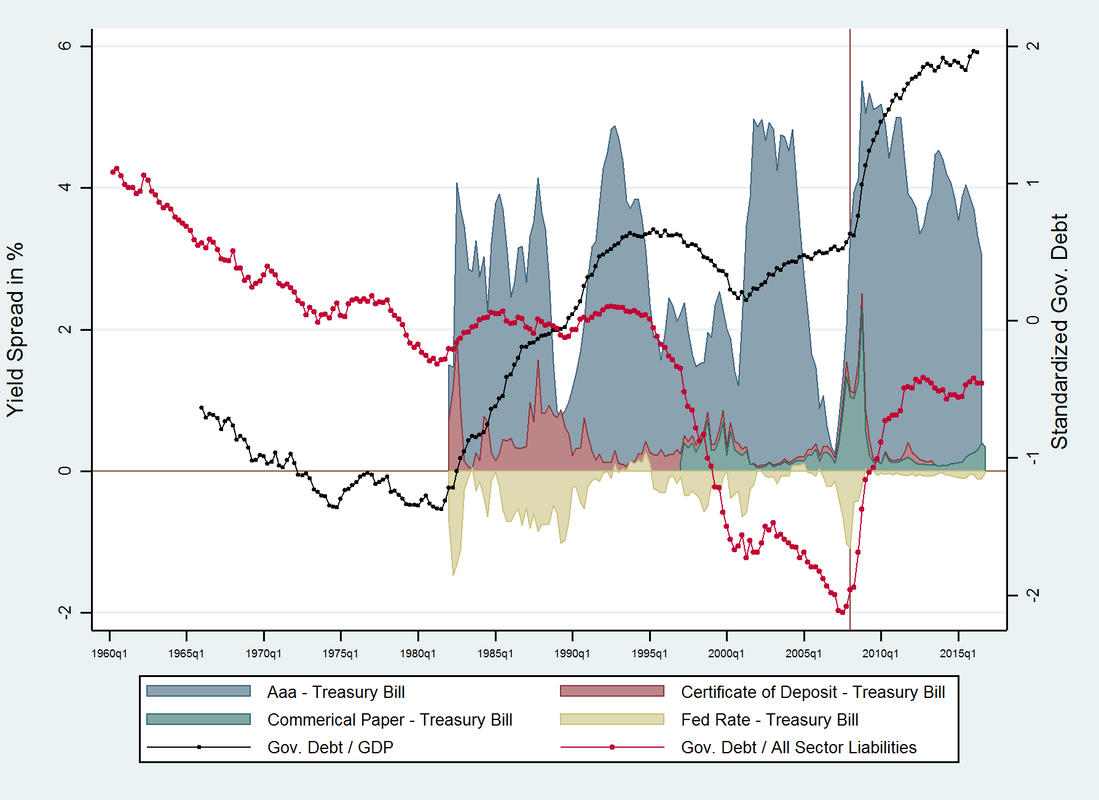

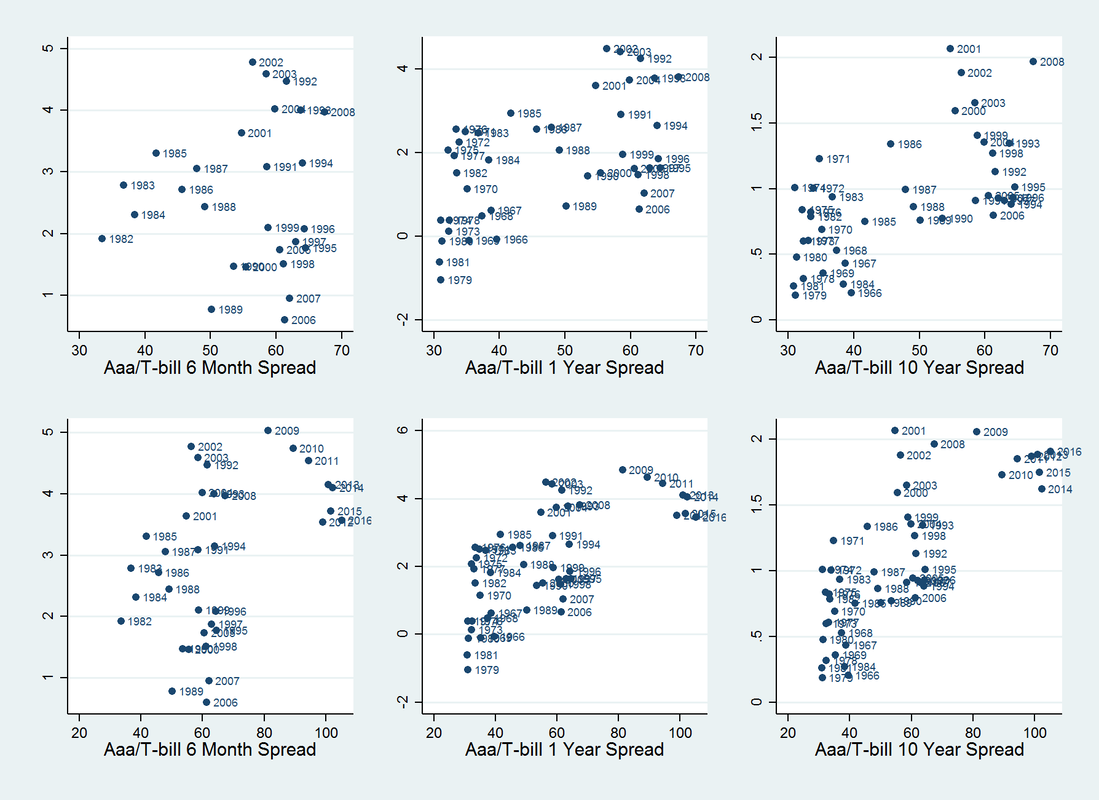

This paper studies the impact of government debt supply on the liquidity premium, as measured by the yield spread between public and private safe assets. I test, at a quarterly frequency, how the liquidity premium of Treasury bills against i) Aaa-rated corporate bonds and ii) commercial paper responds to government debt supply changes. The response is significant in each case – even after controlling for the opportunity cost of money – but heterogeneous: negative for Aaa-rated corporate bonds and positive for commercial paper. This points to different degrees of substitutability with government debt across apparently similar private safe assets.

| xiong_2018.pdf | |

| File Size: | 673 kb |

| File Type: | |

Your browser does not support viewing this document. Click here to download the document.